Preliminary budget forecasts for 2026 and 2027 indicate another property tax increase is on the horizon for Saskatoon citizens.

Chief Financial officer Clae Hack says current projections include a 9.9 per cent property tax increase in 2026 and a 7.3 per cent property tax increase the following year. These equate to about $22 and $18 increases per month for the average home buyer, respectively.

He adds that over one third of these increases can be attributed to Saskatoon Police Service budget increases.

“A significant piece of their increase is related to their collective bargaining agreements. They recently had an arbitration settlement, so they’re funding the results of that, and future collective bargaining estimates are a big part of their budget increase.”

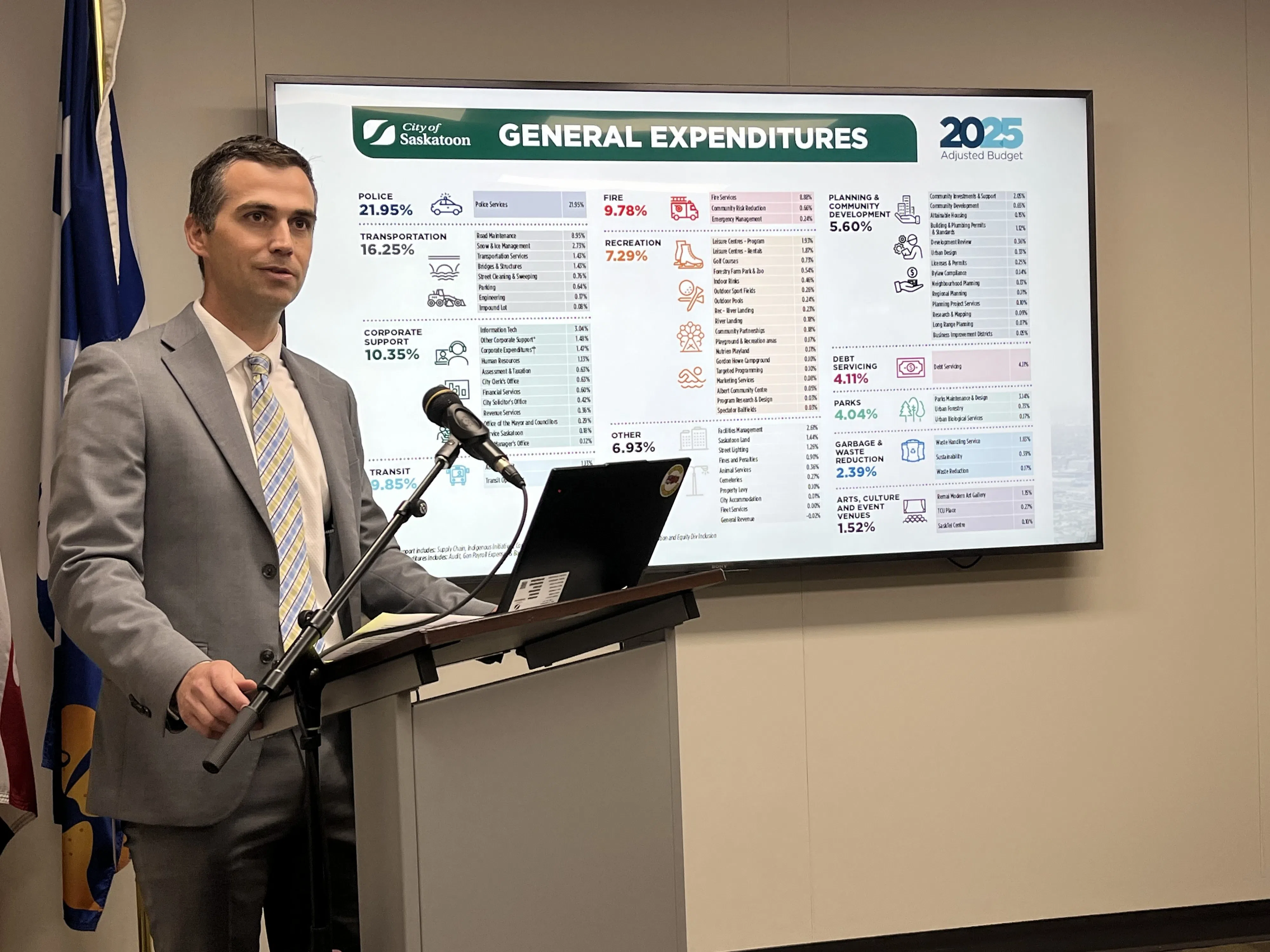

Other services drawing on additional funding include transportation, roadway maintenance, snow removal, and fire services.

Hack adds that both City investments and operating revenues have not been keeping pace with inflation and population growth, and because inflation has significantly impacted the City’s purchasing power, it is forced to rely more on the property tax. He provides an example relating to the purchase of fire prevention equipment.

“Despite nearly $25 million more invested today into fire services than in 2013, this has not kept up with inflation and growth requirements largely since 2022. This means despite record investments in 2025, this investment can buy less fire apparatus, equipment, and hire less fire fighters than it could in 2022.”

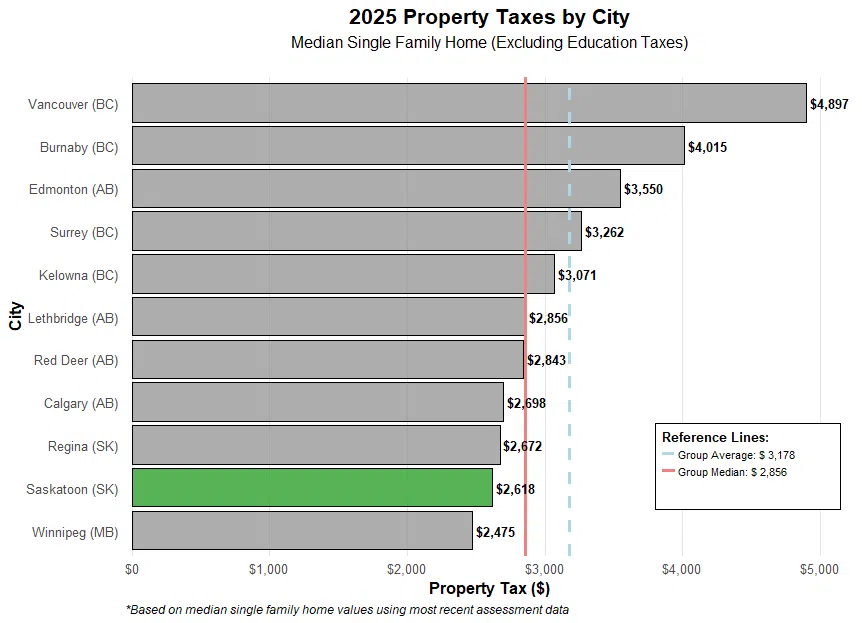

He says the property tax currently funds about 50 per cent of the City’s budget, with the other half being funded by user fees and government grants. Despite the city’s dependency on the property tax to keep pace with inflation and population growth, Hack says Saskatoon still has the second lowest property tax among other Canadian cities, losing only to Winnipeg.

Hack says these figures are not final, and City Administration must reduce these numbers by a minimum of 1 per cent before reporting to City Council in November. He adds that $9 million in 2026 budget expenditures were already cut during Administration’s internal review.

“There’s nobody more than me who would like a zero per cent property tax increase. It’s just unfortunate that it’s the financial world that we’re facing today, and difficult decisions and conversations are going to have to be had over the next six months here.”

An explanatory video will be posted on the City’s website for public view.